The financial processes within a company results in financial information that is used both internally and externally. The processes are subject to rules and regulations which can be changed by the authorities.

The financial processes must be handled with care so that the board, the shareholders, the banks and the authorities receive sufficient information, and are well informed about the company’s financial status.

A correct picture of the company’s economy and value-added statements for the given fiscal period.

A solid foundation for historic and future analysis of the company, useful to both internal and external stake holders.

The most important function within a company is its core activity. Next to that you will find the financial management. All companies, no matter size and industry, are dependent on a healthy financial management.

The finance department has the daily responsibility to follow up on the financial transactions with customers and suppliers. Monitoring and reconciliation of the general ledger postings are other important, daily tasks. Account receivables and account payables aging reports will form the basis for financial statements, reports and analysis that help the board make appropriate short- and long-term decisions.

Base registers - Set-up and maintenance of the Chart of accounts, account defaults, and account groups are examples of the tasks involved in this process.

General ledger - The General ledger (GL) is used to monitor the company’s financial status. This is where you handle the fiscal period closures, VAT calculation and reconciliation, and where you keep track of the stock value. Deviations and errors are detected through the reconciliation of the GL.

Receivables - Handling of payments from the customers, reminders, customer balances and due amounts are examples of the tasks involved in this process.

Payables - Handling of payments to the suppliers, due amount balances, and future deliveries are examples of the tasks involved in this process.

Liquidity - Handling of incoming and outgoing payments from the bank is central in the liquidity management. There are solutions for both manual and electronically handling of payments. Setup, maintenance, and monitoring the bank accounts are included in this process.

Assets - Registration of investments is a part of this process. The fixed asset register provides a detailed overview of the monthly depreciation. There are tools for life cycle management of every single asset.

Budget - Budgeting is essential for analyzing numbers and planning the future by comparison of historic and real values. It is possible to group the general ledger accounts to make the comparison easier.

To open the Finance Workspace (FINANCE) application, find Finance in the RamBase menu and then Overview. Click Overview to enter the FINANCE application.

The workspace gives you a great overview of the finance business area. The workspace is separated into two parts. The left part consists of three sections where the data is set by the program. In the right part, the sections displayed depend on the business area you are working in. In some of the sections you have the possibility to influence the data displayed.

Key figures - This section contains the most important financial key figures. The key figures are updated once an hour, but may be refreshed at any time by using the refresh button.

Actions and links - This section contains links to easily access the most relevant menus and programs. You will not initiate any actions by clicking the action buttons, it will only take you to the screen where you can initiate it from.

Reports - This section lists the most relevant and often used reports for the specific business area. Clicking any of the reports will generate an updated version of the report.

Data filter and mode - In this section you have the possibility to set or delete the selected filter. This filter applies to the whole workspace, if the function or action uses filtering. When filtering on customers/suppliers, the filter will apply to both the Key figures-section and the Data information-section. The specific customer's/supplier's name will be displayed on top of the page.It is also possible to select a mode. A mode is a different view of the workspace data. If the mode is changed, a data table or a workspace overview page will be shown in the Data information-section.

Data information - This section will show different kind of information based on parameters set in the Data filter and mode- section. It can be a data table or a workspace overview. What is displayed in the data table in the Data information-section depends on the filter built in the Data filter and mode-section. For the workspace overview mode, only the account filter parameter will apply.

Workspaces - In this section you will find shortcuts to other workspaces which are related to finance. When working in one of the sub-workspaces you can click on the icon on the upper right to go back to the FINANCE workspace.

The base registers consist of several archives which are used to ensure that the accounting and the finance module are in accordance with the current rules and regulations.

The base registers must be updated when changes are required by the authorities. The company’s need for information is of great importance when setting up the base registers in the finance module. Changes in the company’s processes and routines may also require changes in the base registers.

Rules and regulations are followed

The company’s information needs are covered

The finance module works as planned

The base registers, and the setup of the finance module, must be finished before the accounting personnel start using the system. Then it will be possible to filter the finance data for reporting and analytics.

Grouping the accounts and the financial statements simplify the compilation of the budget and the accounts. It is advisable to plan and define what information you need before you set up the base registers. Using dimensions may be helpful.

Chart of Accounts (ACC) - The Chart of Accounts is central in the finance structure. Every company has their own, unique Chart of Accounts. As companies often follow the same national or international standard, there tends to be similarities between them.

Account definitions (ACD) - A ledger account may have a specific function. Bank, inventory, agio/forex, accounts receivable and accounts payable are examples of accounts that must be set up with certain definitions to interact with the finance module and the rest of the modules in the system.

Report Account Groups (ACG) - The report account grouping functionality is flexible to meet different needs. Grouping the accounts makes it possible to compile the budget and the accounts. This is a great advantage when it comes to reporting and analytics.

General ledger Account Groups (AGC) – Set up in this archive is mandatory for Polish companies to secure correct reporting to the authorities. The set up is mandatory for Polish companies due to JPK reporting. However, there are also templates for Norwegian and Swedish companies.

Value added tax (VAT) – The different VAT codes are set up and maintained in the VAT register. Transactions can be posted with or without tax. Based on the finance module setup, the system will provide a posting suggestion. The VAT register forms the basis for tax reporting and settlement. In RamBase it is possible with multinational tax reporting.

Dimensions (DIM) - There may be needs for dimensions that somehow overlap each other. Several departments connected to the same project is an example. Other dimensions can be cost unit, geographic district or personnel. You can connect several dimensions to one ledger account.

Department (DEP) - The dimension Department is used for isolating costs for activities connected to a specific department. Each department must be clearly defined if the book values are going to be used in reports and analytics. A department can have a budget to enable comparison of the budget and the actual costs. The dimension Department is solely an accounting dimension.

Project (PRJ) - A project is usually an activity that extends over a period. It often includes many processes. The dimension Project is used for isolating costs for a specific activity. A project can have a plan and a budget to enable comparison of the budget and the actual costs. If the numbers are going to be reliable, it is very important to clearly define each project before the accounting personnel start using it. The system setup ensures that the project includes all the relevant posts. The dimension Project is solely an accounting dimension.

Assets (AST) - The dimension Assets is used for keeping track of revenues and expenses connected to a single asset. The dimension Assets is solely an accounting dimension. The depreciation plan and history of previous depreciations are held in the Fixed Assets Register (FAR).

Banks (BANK) – In the BANK archive, a company’s bank accounts are set up. It can be different types of accounts such as operational account, factoring accounts and a tax account. Customers using RamBase will also need a clearing account which is used for countering.

Intercompany register (ICR) – If the company using Rambase is part of a company group, you can set up the other companies in the company group in the ICR archive. The companies set up in ICR does not have to use Rambase. The value set up in ICR consists of three letters as an abbreviation for the company and then 2 letters for the country where that internal company is situated. For example XXX-NO for a Norwegian company. The value set up in ICR is then chosen for the CUS/SUPs (field Intercompany code) that are set up for the internal companies. Documents such as orders/invoices for these internal CUS/SUPs will be marked with the respective Intercompany code. If relevant GL accounts are set up with Intercompany code = Required/Optional this value will be brought into the General ledger (GL) and the user will be able to pull up reports based on intercompany code. Also, in the Period closure register (PAR), there will be a reconciliation between the internal companies.

Inter Company Trading (ICT) – If the company using Rambase is part of a company group, it is possible to set up that outgoing cost invoices, created in one company, should be created as an ingoing invoice in the other company. Companies set up in the ICT archive must use Rambase.

Company settings (CSV) – The archive Company settings is divided by module and sub module. Here, the customer using RamBase, can activate/deactivate and customize several settings to ensure RamBase is working according to the company’s request.

The chart of accounts provides the structure for the general ledger. Adapting of the chart of accounts is necessary to make the book-keeping system fit the economic activity of the business. The chart of accounts is unique for each company, but there are substantial similarities, so it is possible to import a standard chart of accounts when starting up your business accounting. A chart of accounts contains an overview of your ledger accounts.

The Chart of accounts (ACC) application can be used to both adapting the chart of accounts, and to examine the values and underlying transactions posted to each account.

Together with a very flexible use of Account groups (ACG), a RamBase Chart of accounts (ACC) fits into most fiscal structures.

To the left of the application is a list of all the accounts in the selected database. The period selected in the Period field will guide the amount displayed in the list. Use the Search field and/or the Filter builder icon above the list to filter the accounts.

To the right is a more detailed information about the selected account. In the Account info area are some general information about the account.

Account Number - The account number.

Name - Name of the account.

Type - Define if the account is going to be a Result, Profit and Loss (P&L) or Off-balance account.

Category - Bank is mandatory for Bank accounts. Provisions and Prepayments is mandatory if you would like to use more accounts for provisions and prepayments then the one which is set up in ACD/SPATOT (supplier period adjustments total) or ACD/CPATOT (customer period adjustments total). Other values are optional.

SAF-T code - Set the standard account in the SAF-T code field if your company uses SAF-T financial for exchanging accounting data. The SAF-T code field is the basis for the account number reported in the SAF-T file.

Default VAT code - Select the correct VAT code.

Account group - The general ledger account group identifier.

Agio calculation - Use the checkbox if the balances posted to this account should be agio calculated.

Parent account number - Add the parent account in this field. This setting will only be shown if your company has activated a Company setting (CSV) for using the chart of account’s tree structure.

Control account - Use the checkbox if the account is a control account. This setting will only be shown if your company has activated a Company setting (CSV) for using the chart of account’s tree structure.

The Balances tab will display the balance of the selected account. To improve the view, use the Group by field. The transactions can be grouped by:

Period

Department

Finance project

Asset

VAT code

Transaction type

Transaction date

Currency, amounts in local currency

Currency, amounts in foreign currency

Intercompany code

Warehouse location

Year

It is also possible to filter by custom dimensions (DIM4-10) in the Group by field.

Use the Include budget checkbox if you have uploaded a budget to the database and want to see the budget numbers in the Balances tab.

The Dimensions tab defines the dimension parameters to be required, not used or optional. In addition to the dimensions set in the Dimensions (DIM) application, Location (LOC) and InterCompany Database (ICTDB) are also used as dimensions. LOC refers to different warehouse/stock locations, ICTDB refers to transactions between companies within a corporation.

LOC - The parameter is set (Required) for accounts regarding flow of goods, if you want to differentiate the expenses of stock for various stock locations. The values of the LOC dimension are fetched from the LOC application in RamBase.

ICTDB - The parameter is set (Required) for accounts regarding Sale, Purchase and other financial transactions between internal companies. If not set, the accounts receivable and accounts payable will show incorrect values from a corporate point of view.

DEPNO - The parameter is set if you want to connect postings on the account to a certain department. If set to Optional or Required, there is a possibility to set a default department for the general ledger account.

PRJNO - The parameter is set if you want to connect postings on the account to a certain project.

ASTNO - The parameter is set if you want to connect postings on the account to a certain asset (for example a building or a truck).

Other dimensions - The parameter is set if you want to connect postings on the account to other dimensions created in the Dimensions (DIM) application.

The accounts belongs to certain Report account groups (ACG). The use of account groups is usually governed by a set of rules and standards in accordance with financial statement reporting. This tab is used to connect the account to one or more account groups. Note that report account groups are usually managed from the Report account group (ACG) application.

Use this tab to set up and inspect Report account groups (ACG) linked to this account. Use the Link to report account group button to link the account to a new account group.

The settings tab displays general settings for the selected account. Click on the name of the fields to see a description about that field.

Department - The possibility to set a default department.

Effective period - The accounting period for the account to be valid from.

Expiration period - The accounting period for the account to be valid to.

Last GL posting period - The accounting period for the last posting period of the account.

Budget account - The possibility to set the budget account to be compared with the account.

Use the blocking checkboxes to prevent transactions being posted from different registers and/or documents. For example, you can prevent postings to a sales account from the General ledger (ATR) to ensure postings is generated from invoices only. It is possible to block the account from postings generated by:

Sales invoices

Sales credit notes

Sales posting adjustments

Supplier invoices

Supplier credit notes

Supplier posting adjustments

Payments

Manual GL postings

If the account is used for a Fixed assets document (FAR), it will be visible here. The balance account, depreciation account and amounts connected to the fixed asset will be shown.

Use the Forward to fixed asset field to specify how investments should be transferred into the fixed assets register.

When the Chart of accounts is to be setup for the first time, you may do this by importing the customers current chart of account by a file import. The chart of accounts set up can also be done based on a template where you import a template and select the preferred accounts. When the base of the chart of account is a template, the accounts will inherit the account details from the template.

Note

Currently, only templates for a Norwegian or a Swedish Chart of Accounts are available.

Importing a chart of accounts by file import is typically done when the company already has a chart of accounts used in a previous system which they would like to continue using in RamBase.

Information regarding the content and lay out can be found here.

When the file is prepared properly and saved in CSV format, upload can be made from the IO archive (INP/13911). Control of the load can be made by checking the import job in the IOL archive.

Please read about the Load procedure .

When the accounts are imported, they can be found in the ACC archive in Status 4.

To open the Chart of account (ACC) application, find Finance in the RamBase menu and then Base registers. Click Accounts to enter the ACC application.

Click the Create new from template button.

In the new Chart of Account Setup popup, select the country and then select the template from the dropdown menu in the Source field. A table with a tree structure will appear.

From the dropdown menu in the Root Node field, select the group of accounts you want to be displayed.

From the tree structure you select the accounts by use of the checkboxes. If you check an accounting group, all accounts in this group will automatically be selected, but you can deselect any of the accounts.

Click the Select Action button. A popup is opened. Verify that everything is OK before you click the Create button.

In the new popup, that is opened, there are two checkboxes.

Use the checkbox Use agio settings from templates if you want agio settings to be copied from the template for each chosen account.

Use the input field FromPeriod to set the accounting period from which the accounts should be valid. No postings can be made to the account(s) before this period.

Click the Start button and then the OK button to create the accounts. The accounts will now be listed in the Chart of accounts (ACC) application.

If you want to add an account to the Chart of Accounts (ACC), you can create this from a template or manually.

Use the Copy account option in the context field to create a duplicate in Status 1, with the same information as the selected account.

It is possible to create a single or multiple accounts at the same time from a template.

To open the Chart of Account (ACC) application, find Finance in the RamBase menu and then Base registers. Click Chart of Accounts to enter the ACC application.

Click the Create new from template button.

Select which template you want to use in the Source field. A tree structure will appear.

Filter on the account groups in the Root Node field. The accounts with a check-box can be selected. The accounts without check-boxes are already implemented in your Chart of Accounts.

Click the Select Action button. A popup is opened. Verify that everything is OK before you click the Create button.

In the new pop up that is opened there are two checkboxes.

Use the checkbox Use agio settings from templates if you want agio settings to be copied from the template for each chosen account.

Use the input field FromPeriod to set the accounting period from which the accounts should be valid. No postings can be made to the account(s) before this period.

Click the Start Actionbutton and then the OK button the accounts. The accounts will now be listed in the Chart of accounts (ACC) application.

The imported account(s) will have a standard setup, but it is possible to alter and add more information to the account when the account is in Status 1. For more details, please read point 5, 6, 7, 8 and 9 in the chapter Create a new ledger account manually below.

Start from the Chart of Accounts (ACC) application.

Click the Create new account button.

Insert values in the fields:

Account Number - The account number. Maximum 50 characters and possible characters are:

0-9

a-z, A-Z

Symbols (.,_-)

Name - Name of the account.

Type - Define if the account is going to be a Result, Profit and Loss (P&L) or Off-balance account.

Default VAT code - Select the correct VAT code.

Effective period - The accounting period for the account to be valid from.

Parent account number - Add the parent account in this field. This setting will only be shown if your company has activated a Company setting (CSV) for using the chart of account’s tree structure.

Click the Create button to create the account to Status 1. You will now see the account details and it is possible to add more information.

To open the Chart of Account (ACC) application, find Finance in the RamBase menu and then Base registers. Click Chart of Accounts to enter the ACC application.

Highlight the specific account which in not activated. The account will be in Status 1.

Select the Activate account option in the context menu.

The account is now activated to Status 4 in the Chart of Accounts (ACC) application.

All new accounts that are not activated in the Chart of Accounts yet will be set to Status 1. If you want to list these accounts, use the filter field to filter the list of accounts to accounts with Status 1. You have to activate the accounts one by one when they are ready to be activated.

To open the Chart of Account (ACC) application, find Finance in the RamBase menu and then Base registers. Click Accounts to enter the ACC application.

Highlight the specific account.

Optionally, use the Search field or click on the Filter builder icon above the list to filter the accounts.

To open the Chart of account (ACC) application, find Finance in the RamBase menu and then Base registers. Click Accounts to enter the ACC application.

Highlight the relevant account. The Balances tab is the main working area to inspect the transactions posted to an account.

To improve the view, use the Group by field. The transactions can be grouped by:

Period

Department

Finance project

Asset

VAT code

Transaction type

Currency, amounts in local currency

Currency, amounts in foreign currency

Intercompany database

Warehouse location

Year

It is also possible to filter by custom dimensions (DIM4-10) in the Group by field.

Use the Include budget checkbox if you have uploaded a budget to the database and want to see the budget numbers in the Balances tab.

Click the icon next to the transaction value in the Balances tab to open the general ledger journal. This will show the postings from general ledger and payable / receivable account specifications.

The Off-balance account is a third type off General ledger account, in addition to Balance and Result. To activate this functionality, enter the Company settings (CSV) application and select Finance -> GeneralLedger. Here you can find the setting: Activate Off-balance account functionality. When this setting is activated, user will be able to choose Off-balance as account type on general ledger accounts. If you do not have access to the CSV application, please send in a request to your partner, or directly to RamBase if you are not connected through a partner.

All general ledger postings must balance out for result accounts and balance accounts and off-balance accounts separately. This is because the off-balance accounts are not included in the standard balance sheet of the company. Therefore, a posting to an off-balance account must always be balanced out by another off-balance account.

When creating ingoing balance to a new fiscal year, balance from off-balance accounts will be cleared and not added to the new year. If you want to bring the balance from last year to the new year, this must be done by a manual general ledger posting.

Off-balance accounts will not be shown in any reports as a default. If you want to include off-balance accounts in your account reports this can be done by entering the report parameter before opening the report:

Here, you can find Include off-balance accounts. Check this box if you want to include the off-balance accounts in the given report.

A Report account group (ACG) is composed of a certain number of accounts with similarities. The purpose of grouping accounts is to comply with accounting standards due to financial statement requirements, but it could also play a part in proper financial management and control. Grouping of accounts gives you an improved financial outline in reports

1xxx Assets

2xxx Equity and liabilities

3xxx Sales and operating revenues

4xxx Purchasing costs

5xxx Wages

6xxx Operating costs

7xxx Operating costs

8xxx Financial revenues and costs

In RamBase it is possible to customize account groups. For example, if the standard ACGs do not meet your report requirements, you may create a new ACG for this purpose, and map it to a report.

It is possible to inspect an accounting group or create a new group from the Report account groups (ACG) application.

The Report account groups (ACG) application menu is a simple report in itself. If there are posted ATR documents to the accounts in an account group, the group totals will show up in this window from a two-column view showing selected (period and/or year to date (YTD)) values.

To examine the postings or edit an ACG, select the ACG and press ENTER.

The Period From field holds information about the first valid accounting period for the ACG.

The Range and Selected Accounts fields is the key fields to build an ACG. To tie accounts to a group, you could either enter a range of accounts or select single accounts. It is only possible to use one of the methods. It is faster to enter a range of accounts than to pick a group of single accounts. However, a range of accounts will include all accounts in the range, so if one or more accounts should not be a part of the ACG, the select account method must be used instead.

If the select method is use when setting up an ACG, the user must remember to add accounts to the ACG when new accounts are created, otherwise the new accounts will not be included in the ACG and also not included in any reports where the ACG is included.

Click on the magnifier icon to tie accounts to an ACG. ACG are not exclusive. An account could be connected to several ACG.

Create a new account group

In addition to the standard Report account groups (ACG), it is possible to create customized report account groups. For example, if the standard ACG do not meet your report requirements, you may create a new ACG for this purpose, and map it to a report. Another situation is if you want an overview of the balance of several accounts, create a new group based on these accounts.

To open the Report Account Groups (ACG) application, find Finance in the RamBase menu and then Base registers. Click Report account groups to enter the ACG application.

Click the Create ACG/.. icon.

Give the report group a name and set the first period it is going to be used in the FromPeriod field. This will be the first valid accounting period for the ACG.

Connect general ledger accounts to the group. There are two methods for picking the accounts, and these two methods can not be combined.

Select a range of accounts:

Click the magnifier icon next to the Range field.

In the Account group subselect popup, set the first and the last account in the range of accounts you want to connect to the group.

Click the OK button. The accounts will be listed in the Accounts section.

Pick single accounts:

Click the magnifier icon next to the Selected Accounts field.

In the Select Account popup, use the checkboxes to select the accounts. It is possible to search for accounts or name of an account.

If a range already is selected, this range will be overruled by the changes you make in this popup.

On the top of the popup you will see the name of the account group and the number of accounts connected to it.

Click the OK button. The accounts will be listed in the Accounts section.

When all accounts are connected to the group, register the ACG to Status 4 by using the menu option Register Account Group.

In addition to the standard Report account groups (ACG), it is possible to create customized report account groups. For example, if the standard ACG do not meet your report requirements, you may create a new ACG for this purpose, and map it to a report. Another situation is if you want an overview of the balance of several accounts, create a new group based on these accounts.

To open the Account Groups (ACG) application, find Finance in the RamBase menu and then Base registers. Click Report account groups to enter the ACG application.

Click the Create ACG/.. icon.

Give the group a name and set the first period it is going to be used in the FromPeriod field.

Connect ledger accounts to the group. There are two methods for picking the accounts, and these two methods can not be combined:

Select a range of accounts:

Click the magnifier icon next to the Range field.

In the Account group subselect popup, set the first and the last account in the range of accounts you want to connect to the group.

Click the OK button. The accounts will be listed in the Accounts section.

Pick single accounts:

Click the magnifier icon next to the Selected Accounts field.

In the Select Account popup, use the check-boxes to select the accounts.

If a range already is selected, this range will be overruled by the changes you make in this popup.

On the top of the popup you will see the name of the account group and the number of accounts connected to it.

Click the OK button. The accounts will be listed in the Accounts section.

When all accounts are connected to the group, press F12, to open the action menu and choose the Register Account Group option to activate the ACG.

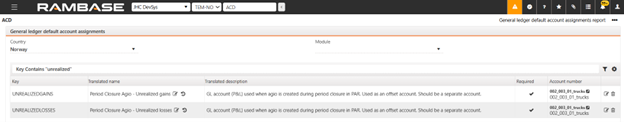

The Account defaults (ACD) setup is done to automate the book-keeping to a certain extent. In RamBase some Account defaults (ACD) are mandatory, but most are optional. The Account defaults (ACD) setup in RamBase can be quite extensive, but will ensure efficiency and control of the ledger postings. The Account defaults (ACD) can be set up module by module for improved overview.

The Account defaults (ACD) application lists all General ledger default accounts (ADD) available for default account settings. You may filter the most relevant default accounts by using the drop-down menu in the Module field.

Click the Edit icon and use the drop-down menu to set or change default accounts.

In RamBase, department, projects and assets are dimensions available by default. It is also possible to generate up to seven individually adapted dimensions. The dimensions are listed in, and can be maintained, from the Accounting dimensions (DIM) application.

Default dimensions are set to Status 8. The individually adapted dimensions are set to Status 4, and the dimensions being created are set to Status 1.

To inspect values of a dimension, click on the specific dimension.

Dimension values can be retrieved in three different ways:

From other base registers in RamBase (per now limited to the Personnel (PER) application).

Entered manually in the DIM application as custom value list.

Field values from transaction documents could be linked to a dimension.

Dimensions can be allocated to each account with the settings:

Not Used (inaccessible).

Required (mandatory).

Optional (optional).

The use of dimensions should be well considered. Your company's need for financial reporting and control should decide the use of dimensions. It will make you able to achieve financial reports on each dimension, but excessive use of dimensions will require some more work for the accountants when account dimensions should be updated on invoices, credits and other finance transactions.

To open the Dimension (DIM) application, find Finance in the RamBase menu and then Base registers. Click Dimensions to enter the DIM application.

To create a new Dimension (DIM), it must exist less than ten dimensions as ten dimensions are the maximum numbers of dimensions possible to use.

Click the Create new dimension button.

Enter a name in the Name field and click the OK button to create a Dimension (DIM) in Status 1.

Select one of the options in the Setup field.

From archive field values - When you select this option, it is required to select archive in the Archive field. Use the dropdown menu in the Archive field and select the archive you want to use for the dimension. For example the Personnel (PER) application.

From object/document - When you select this option, it is required to select field in the Field field. Use the dropdown menu in the Field field and select the field you want to use for the dimension. These fields are retrieved from transaction documents like Invoices (CIN / SIN), Credit Notes (CCN / SCN) and Payment (PAY). The values from these fields will automatically be posted in the dimension, when the transactions are posted to the GL.

From user defined values - It is possible to create your own dimension codes. For example, make dimensions for more detailed overview of costs and revenues on specific business areas, consulting, or research-/ test-/ planning activities. To add a new dimension code:

Click the Add value button in the Values folder.

Add information in the popup.

Click the OK button.

When all values are added to the Dimension (DIM), click the Activate Account Dimension Definition option in the context menu. It is now ready for use.

It is possible to see the general ledger accounts in the General ledger accounts folder and set if the Accounts (ACC) is Not Used, Required or Optional to use for the Dimension (DIM)

You may filter the result using the filter field in the top of the folder.

The button Apply requirement for all filtered accounts is implemented to simplify the update of the requirement for all GL accounts, based on the Enter your search criteria here field. This button can be found under the General ledger accounts tab in the Dimensions area.

In this example, all account starting with 37 is filtered. They are set up with the requirement Not used for dimension=DEP. After having filtered the desired accounts, click the button Apply requirement for all filtered accounts. In the pop up, the user can set the new requirement to be applied for all selected accounts and press Apply. Now all the selected accounts are updated to the new requirement.

The Department (DEP) application holds information about the departments in the company. The purpose of the DEP application as an account dimension, is to be able to pull up income statements, cost specifications and other financial reports from the various departments. In RamBase, the DEP is also used to connect assets to certain departments.

To open the Department (DEP) application, find Finance in the RamBase menu and then Base registers. Click Departments to enter the DEP application.

Click the Create new department button in the lower left-hand corner of the application.

In the popup, insert values in the fields:

Id - The id of the Department.

Name - The name of the Department.

Effective period - The period for the Department to be valid from (YYYYMM).

Click the OK button. The Department will now be set to status 1. It is still editable, and needs to be activated in order to enable it for use.

Click the Activate department option in the context menu. The Department will be set to status 4 and is ready to be used.

The transactions posted to a distinct Department (DEP) can be examined in the General Ledger Balances area. Use the Department and General Ledger Balances areas to follow up on the Department.

In the Department area it is possible to add optional information:

Description - Description of Department.

Responsible - Set the Employee (PER) responsible for the Department in this field.

Expiration period - Expiration period of the Department.

In the General Ledger Balances tab it is possible to check ledger entries posted against a specific Department. The values in the chart are period year to date amounts:

Accounting period - Set the wanted accounting period (YYYYMM). Only last 2 years are allowed.

Choose between Balance and Result - See the totals from the balance or the result accounts.

Line chart with totals from balance/result accounts - To see the account details, click on one of the circles in the line chart to open the popup General ledger accounts results/balances from the selected period.

The Period Amounts tab shows all historic period amounts and year to date amounts for the selected department, both for the balance side and the result side. The period amounts and year to date amounts has 2 links:

Click on the number to inspect the detailed Ledger Specifications (CAS & SAS items).

Click on the icon behind the amount to inspect the General Ledger Postings (ATR items).

The Project (PRJ) application lists and holds information about all projects in the company. The purpose of the PRJ application as a account dimension, is to be able to pull up income statements, cost specifications and other financial reports from the various projects. In RamBase, the PRJ is also used to connect assets to certain projects.

Examples where the project dimension may be beneficial are when you need to calculate the actual profit from a large delivery where the income is given from a tender, or when you want to keep an eye on the development costs in a development project.

To open the Project (PRJ) application, find Finance in the RamBase menu and then Base register. Click Finance projects to enter the PRJ application.

Click the Create new finance project button in the lower left hand corner of the application.

In the popup, insert values in the fields:

Id - The id of the Project.

Name - The name of the Project.

Effective period - The period for the Project to be valid from (YYYYMM).

Click the OK button. The Project will now be set to status 1. It is still editable and needs to be activated in order to enable it for use.

Click the Activate project option in the context menu. The Project will now be set to status 4 and is ready to be used.

The transactions posted against a specific Project (PRJ) can be examined in the General Ledger Balances tab. Use the Finance projects area and the General Ledger Balances tab to follow up on the Project.

In the Finance project area it is possible to add optional information:

Description - Description of Finance Project.

Responsible - Set the Employee (PER) responsible for the Project in this field.

Expiration period - Expiration period of the Finance Project.

In the General Ledger Balances tab it is possible to check ledger entries posted against a specific Project. The values in the chart are period year to date amounts:

Accounting period - Set the wanted accounting period (YYYYMM). Only last 2 years are allowed.

Choose between Balance and Result - See the totals from the balance or the result accounts.

Line chart with totals from balance/result accounts - To see the account details, click on one of the circles in the line chart to open the popup General ledger accounts results/balances from the selected period.

The Period Amounts tab shows all historic period amounts and year to date amounts for the selected project, both for the balance side and the result side. The period amounts and year to date amounts has 2 links:

Click on the number to inspect the detailed Ledger Specifications (CAS & SAS items).

Click on the icon behind the amount to inspect the General Ledger Postings (ATR items).

The Assets (AST) application holds information about your investments. The AST application is used to group depreciation, costs or possible revenues from an asset together, in order to report the accounts for this specific investment.

The purpose of the AST application as an account dimension, is to be able to draw income statements, cost specifications and other financial reports, such as overviews of planned and performed depreciation, from the various assets.

For every new investment it is recommended to register the investment in the AST application.

It is recommended to register every investment to an Asset (AST). Then it is possible to monitor costs, depreciations and revenues for the specific item. An AST can also be created for groups of assets. Typically for smaller investments. (It would be reasonable to have an AST for 'Servers', but maybe not for 'Dell XPG356 Server')

To open the Assets (AST) application, find Finance in the RamBase menu and then Base registers. Click Assets to enter the AST application.

Click the Create new asset icon in the bottom of the application.

In the Create new asset popup, insert values in the fields:

Id - The id of the AST.

Name - The name of the AST.

Effective period - The accounting period for the ASTs to be valid from (YYYYMM).

Click the OK button. The AST will now be set to status 1. It is still editable and needs to be activated in order to enable it for use.

Add relevant information.

Click the Activate finance asset option in the context menu. The AST will now be set to status 4 and is ready to be used.

The transactions posted against a specific Asset (AST) can be examined in the General Ledger Balances tab. Use the Asset area and the General Ledger Balances, Period Amounts and Fixed Assets tabs to follow up on the ASTs.

In the Asset area it is possible to add optional information:

Description - Description of the AST.

Expiration period - Expiration period of the AST.

In the General Ledger Balances tab it is possible to check ledger entries posted against a specific AST. The values in the chart are period year to date amounts:

Accounting period - Set the wanted accounting period (YYYYMM). Only last 2 years are allowed.

Choose between Balance and Result - See the totals from the balance or the result accounts.

Line chart with totals from balance/result accounts - To see the account details, click on one of the circles in the line chart to open the popup General ledger accounts results/balances from the selected period.

The Period Amounts tab shows all historic period amounts and year to date amounts for the selected AST, both for the balance side and the result side. The period amounts and year to date amounts has 2 links:

Click on the number to inspect the detailed Ledger Specifications (CAS & SAS items).

Click on the icon behind the amount to inspect the General Ledger Postings (ATR items).

The General ledger (GL) is a complete record of all financial transactions in a company. The general ledger holds account information that is needed to prepare financial statements, and it includes accounts for assets, liabilities, owners' equity, revenues and expenses.

All transactions are posted to the general ledger, either manually, or automatically by the system.

An accurate financial statement.

Consistency between the general ledger postings and the "real world".

Traceability and documentation of the postings.

An advanced interface between the transactions and the ledgers, will provide you with tools for reconciliation and quality assurance, which makes it possible to do a traceable and high-quality year-end closing on a month by month basis.

Make posting adjustments.

Make period adjustments.

Reconcile ledger accounts, VAT and the bank accounts.

Close the fiscal period.

Agio calculation.

Inspect balance sheet values.

Deviation handling.

Setting name | Description |

Activate Off-balance account functionality | Used to activate off-balance accounts as an account type on General Ledger accounts. |

Activate tree structure functionality on GL accounts | Used to activate tree structure functionality on General Ledger accounts. In the chart of accounts, the possibility to define control accounts and to select a parent account is available. |

Automatically create VAT posting when manual GL postings are registered | If this setting is "ON" - VAT posting will be automatically created when manual general ledger postings are registered. |

Creating accounting years manually | Setting to define if the accounting periods are created manually by the user. If the setting is not activated, the periods will be created by the system automatically. In this case the system handles 12 posting periods from January to December. If your company is running January to December, do not turn on this setting! |

First period in General ledger | First period the company should have postings to the Finance system in rambase. Format: YYYYMM |

Import of work in progress to general ledger | Used to activate functionality that will calculate total value of ongoing, open Product Work Orders (PWO), so that accrued cost from these work orders (work in progress) could be posted to General Ledger (ATR). |

Import wages to general ledger accounting dimension mapping | Used to map the RamBase accounting dimensions (DIM) with the fields from the import file "Visma wages". Only the fields ELEMENT1 to ELEMENT5 from the file format and only the Rambase accounting dimensions DIM4 to DIM10 can be used for the mapping and only RamBase dimensions which are defined with user defined values. The value must be a comma-separated list, where each element follows this format: <Field from the file>:<RamBase accounting dimension> If no value is defined in this setting, the upload logic tries to find an employee in all ELEMENT fields if a dimension is defined for archive PER. Otherwise this logic will be deactivated. Example: ELEMENT2:DIM3,ELEMENT3:DIM4 |

Notification PIDs for general ledger account issues | Comma list of PIDs that will get a notification by IMS for finance issues related to general ledger accounts. |

Notification PIDs for general ledger issues | Comma list of PIDs that will get a notification by IMS for finance issues related to general ledger. |

Planned import for inventory balance to General ledger | Value in this setting determines Daily (D) or Monthly (M) automatic import of Inventory balance to General Ledger Postings (ATR) |

Planned import for product balance to General ledger | Value in this setting determines Daily (D) or Monthly (M) automatic import of Product balance to General Ledger Postings (ATR) |

Rate for importing inventory balance to general ledger (Do not update manually !) | Specifies which rate should be used when inventory balance is imported to General Ledger. "PERIODIC" means rate from last day of Period. "HISTORIC" means rate from transaction date of inventory reception. ****** This setting should NOT be updated manually, as value in this setting is automatically updated based on Companies GM model, updated in COM. ***** |

Rate for importing product balance to general ledger (Do not update manually !) | Specifies which rate should be used when product balance is imported to General Ledger. "PERIODIC" means rate from last day of Period. "HISTORIC" means rate from transaction date of transaction document. ****** This setting should NOT be updated manually, as value in this setting is automatically updated based on Companies GM model, updated in COM. ***** |

Agio calculation reevaluates the book value on the balance accounts by upgrading the values from historic rate to period rate. All transactions will be posted with the currency rate on the date of registration (historic rate), but by the end of the month all transactions will be calculated with the same currency rate (period rate).

The agio calculations in RamBase are based on the rates in the Currency (CUR) application. The rates in the CUR application are yesterday's currency rates, and they are daily updated.

Agio calculation is optional. Only balance accounts can be agio calculated. Each of the accounts that one wishes to be agio calculated must be defined in the Agio field in the Chart of accounts (ACC).

https://help.rambase.net/en/finance/general-ledger/agio.html

The system tracks agio as either unrealised or realised. Unrealised agio is calculated at period end for unpaid foreign currency items and remains on the balance sheet. Realised agio is recorded when payments are made, moving amounts from unrealised to realised and posting against the actual payment.

The behaviour of splitting agio into unrealised and realised is controlled by a system-level setting. Once activated, all foreign currency transactions follow this model, ensuring consistent accounting treatment of gains and losses.

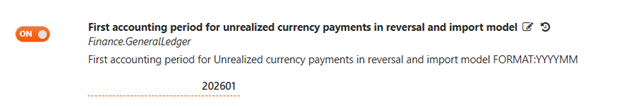

The company setting is called First accounting period for unrealized currency payments in reversal and import model.

RamBase has two processes for calculation of agio, both are described below. The first process is done during period closure by the user. The second one is done automatically by RamBase when registering customer and supplier payments.

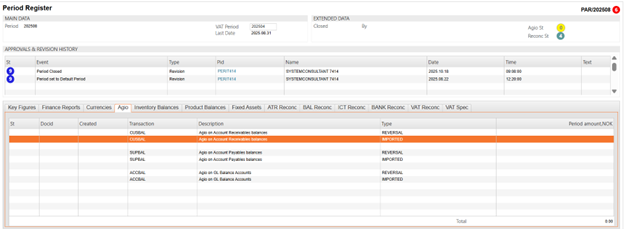

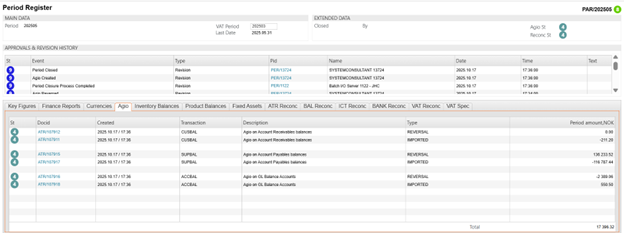

The calculation of the unrealized agio is performed in the Period Account Register (PAR). One of the procedures during period closure is to import the unrealized gain and losses to the general ledger.

When closing an accounting period, the closing period's opening balance must be reversed, and the current period's balance must be imported. The import job will automatically split the unrealized gains and losses.

To open the Period Account Register (PAR) application, find Finance in the RamBase menu and then General ledger. Click Accounting periods to enter the PAR application.

Highlight the relevant period and press ENTER.

Select the Agio folder.

Right click and chose menu option Create reverse and import agio.

If everything is correct, the lines will now be marked with Status 4 with a reference to a general ledger entry. Agio status in the upper right corner will be Status 4.

Agio calculation in PAR will create 3 sets of documents:

CUSBAL - Agio on Account Receivable (AR).

SUPBAL - Agio on Account Payables (AP).

ACCBAL - Agio on all other GL accounts (Not AR & AP).

General ledger postings (ATR) documents for CUSBAL and SUPBAL will be calculated based on customer and supplier balances in foreign currencies. Each ATR item will have a reference to a Customer / Supplier Account and currency. The amount will be calculated based on:

For all transactions (CAT & SAT) that are open by the end of current period, but registered in earlier periods: Agio will be calculated using the transaction rate and the current period-end rate.

ATR document with transaction type ACCBAL will handle all other GL accounts (Not AR & AP) and agio will be calculated this way:

For all transactions (ATR items) that are registered in earlier periods: Agio will be calculated using the transaction rate and the current period-end rate.

Your system currency is USD.

You have a CIN for 100 EUR.

The day the CIN was registered (St:4) the rate was 1,1.This means that the value of this CIN in your system currency is (100*1,1) = 110 USD.

The registration of the CIN generates an open post in the Accounts receivable ledger for 110 USD.

On the last day of the month the rate was 1,2 (Period rate).

By the end of the month the open post was agio calculated based on the period rate and the currency rate on the date of registration.(100*1,2) - (100*1,1) = 10This means an agio profit of 10 USD.

If the CIN is not paid by end of next month, the unrealized agio for the previous month will be reversed and the open post (CIN) will be agio calculated based on the new period rate and the currency rate on the date of registration.

The new period rate is 1,4.

(100*1,4) - (100*1,1) = 30. This means an agio profit of 30 USD.

When payment occurs, any unrealised agio is moved to realised agio. For example, if the invoice is paid at a rate of 1,5 EUR/USD, the difference between the transaction rate and payment rate is posted as realized agio on the payment.

Relevant report: FRP > ACCBAL > GL Account Balances, from AGIO calculations.

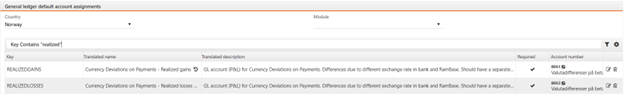

GL accounts set up in Account Defaults (ACD) for Unrealizedgains and Unrealizedlosses are used when agio is created during period closure in PAR. Used as an offset account.

ACD/UNREALIZEDGAINS and ACD/UNREALISEDLOSSES

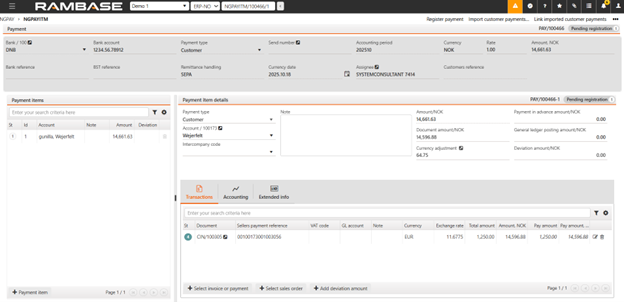

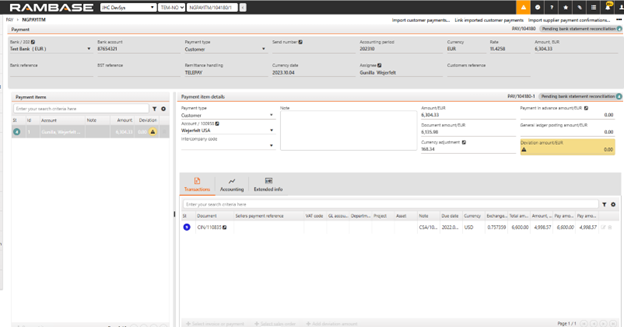

For all invoices or credit notes linked to a payment, realized agio will be calculated using the exchange rate from the transaction date and the exchange rate from the payment date to determine the value in local currency. This applies to all invoices or credit notes regardless if they are registered in an earlier period or in the same period as the payment. The realized agio is presented in the field Currency Adjustment on the payment.

GL account for Currency Deviations on Payments.

Scenario Example:

Payment Currency: NOK (Norwegian Krone)

Invoice Currency: EUR (Euro)

In this example:

The sales invoice is for 1,250 EUR, registered on 2025.09.18 with an exchange rate (RATE) of 11.626.

The payment has a CURDATE of 2025.10.18, with a RATE of 11.7293.

The Currency adjustment field reflects the currency deviation, calculated as follows:

Determine the Payment Value in Local Currency (NOK): 1,250 EUR * 11.7293 (CURDATE RATE) = 14 661,63 NOK

Determine the Invoice Value in Local Currency (NOK) Based on RATE from invoice: 1,250 EUR * 11.626 (2025.09.18 RATE) = 14 532,50 NOK

Calculate the Currency Adjustment: 14 661,63 NOK – 14 532,50 NOK = 129,13 NOK

The resulting currency adjustment of 129,13 NOK reflects the gain (or loss) due to exchange rate fluctuations between the invoice registration and payment dates.

When payments are processed, unrealised agio from previous periods is automatically transitioned to realised agio and posted to the appropriate gain or loss account.

The Currency Adjustment field includes an Inspect feature:

Clicking this allows you to view a detailed report of the currency loss or gain for the selected invoice and any credit notes linked to the payment.

This report helps trace and verify how the deviation was calculated.

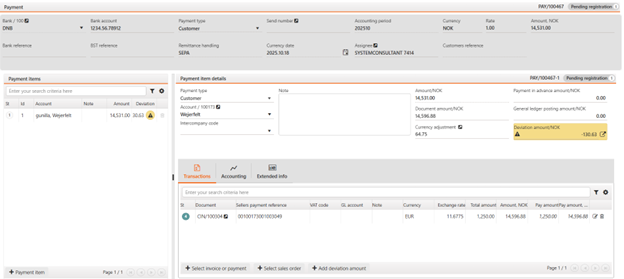

Differences due to different exchange rate in bank and RamBase. This is the difference between the value of the invoice based on RATE of the Currency date and what is received in bank. This deviation in «Deviation amount» could also contain of for example bank fees.

Example Calculation:

Invoice amount: 1 250 EUR

Exchange rate on Currency date: 11.7293

Invoice value in base currency: 1250 ×11.7293 = 14 661.63

Amount received in the bank: 14 531

Difference (Deviation Amount): 14 661.63−14 531=−130,63

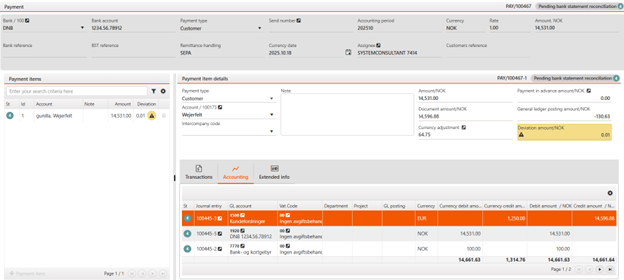

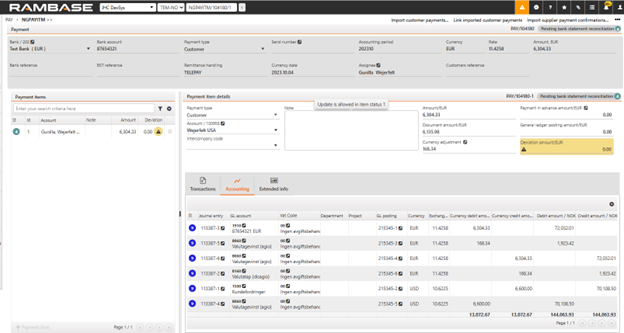

The user must decide how to post this deviation to the General Ledger (GL). This process is performed manually. The accounting for the above payment will look like this:

GL account used when payments in foreign currency is posted to General Ledger:

When payment and invoices/credit notes have different currencies, additional posting is made to balance out the GL postings.

When a payment has many invoices and credits with different exchange rates, GL postings may not balance because of round offs on calculated average exchange rates. Additional posting for exchange rate difference is then made, if this difference is less than given in CompanySetting "MaxPaymentCurrencyDeviationOnLedgerSpecification".

Scenario: Currency Deviations on Payments

Calculate the invoice value from USD to the base currency (NOK):

Based on the last day of the previous month: 6,600 USD×10.9139=72 031.74 NOK

Based on Currency date: 6,600 USD×10.6225=70 108.50 NOK, Difference: 72,031.74−70,108.50=1 923.24 NOK

Convert the NOK difference to EUR (PAY is for a Euro bank account): 1,923.24 NOK÷11.4258=168.32

When the amounts in USD and EUR are exchanged to NOK, two EUR postings are created because of the currency posting.

Typically, only minor round-offs are posted to this account due to rounding of exchange rates and two-decimal resolution in GL.

The effect on ACC/8060 for this payment will be:

This GL account is used when VAT adjustments are needed due to differences between the VAT rate and the exchange rate on invoices or credit notes.

Example Scenario:

An inbound invoice (SIN) has a VAT rate (VATRATE) that differs from the exchange rate (RATE):

RATE: 11.4258

VATRATE: 11.2535

VAT amount: 250 EUR

Calculation:

Convert VAT amount using RATE: 250 EUR×11.4258=2 856.45 NOK

Convert VAT amount using VATRATE: 250 EUR×11.2535=2 813.375 NOK

Difference: 2,856.45−2,813.375=43.08

Accounting Impact:

This difference of 43.08 NOK is posted to ACD/VATRATEADJ.

The accounting will look like this:

Accounting period closure is performed in the Period account register (PAR) application in RamBase. The different tabs for one accounting period in PAR will give you an overview of various types of reconciliations such as inventory, work in progress, VAT and bank. Deviations should be followed up and the user will be able to approve the different reconciliations from the PAR application.

To open the Period account register (PAR) application, find Finance in the RamBase menu and then General ledger. Click Accounting periods to enter the Period account register (PAR) application. As a default, you will enter the year with the latest active period.

Status 1 - Future period not activated. It is possible to post to it.

Status 4 - Active period for posting.

Status 6 - Period closure is ongoing. Only selected roles are allowed to post.

Status 8 - Period closing approved, ready to be closed.

Status 9 - Period closing finished.

Make sure to keep the closing account period in an editable mode (status 6) until all reconciliations and inspections are completed, then confirm the period closure (status 9) to close the period in the Period account register (PAR) application.

Click on the year you want to view.

Use the Open, Active, Closing not approved, Closing approved and Closed boxes to filter the selected accounting year and make the accounting period closure easier.

Click the cogwheel to the right in the application to add or remove columns.

Start in the Period account register (PAR) application.

Highlight the period after the one which is going to be closed and press ENTER.

Use menu option Set this period to: Default period.

The new default period will be listed in the Period account register (PAR) application marked with status 4, which indicates that this is an open accounting period. When to change the default period depends on your company's routines, but is often to be done either the first day of the new period or at the time you are to perform period closure.

Start in the Period account register (PAR) application.

Highlight the actual period which is going to be closed and press ENTER.

Use the menu option Set this period to: Closed period.

The period to be closed will be listed in the Period account register (PAR) application marked with Status 6, which indicates that this period is no longer open for entries and only authorized accounting personnel may continue working on this period.

The period to be re-open will be listed in the Period account register (PAR) application marked with Status 6. Set the period previous to the period you want to re-open as closed.

Start in the Period account register (PAR) application.

Highlight the period previous to the period you want to re-open and press ENTER.

Use menu option Set this period to: Closed Period.

The period to be re-opened is now in Status 4. Re-opened period will have agio reversed.

The period to be open will be listed in the Period account register (PAR) application marked with Status 9. Only the last period that was closed can be opened.

Start in the Period account register (PAR) application.

Highlight the period which is going to be opened and press ENTER.

Use menu option Open period.

The period to be re-opened is now in Status 6.

Firstly, a company setting (CSV) called Creating accounting years manually must be activated. NB! Do not use this functionality if your company’s accounting year runs January to December.

When the above company setting is activated, you will see a + icon at the latest year in the top of the PAR menu.

When clicking this icon, the popup Create accounting year appears. Here you enter a value in the fields Count of periods, Start date, End date.

Press Create and the periods appears and you must fill in Start date and End date for each accounting period. It is possible to add a description for the periods. Then press Create.

The accounting periods are created in Status 0.

If the accounting year created is wrong, it can be deleted as long as the periods are in Status 0 by using the menu option Delete accounting year.

Use menu option Activate accounting year to set the accounting periods to Status 1.

Period- and posting adjustments are posted from transaction documents, and it is crucial to the general ledger to make the income and costs for a period or dimension as accurate as possible.

Period adjustments is done to distribute the costs or incomes to several accounting periods if an invoice is created for a certain time span.

Posting adjustments is done to distribute costs or incomes to several dimensions (department, project etc). While period adjustments are crucial to make the profit and loss report as accurate as possible, posting adjustments points towards cost accounting.

In the default account archive (ACD), set up of general ledger accounts for period adjustments can be made. You can set up one GL account for customer period adjustments and one GL account for supplier period adjustments.

It is possible to set up additional general ledger accounts to be used when performing a period adjustment. Enter the preferred general ledger account and select Provisions & Prepayments from the Category dropdown menu in the Account information area. Once categorized, these accounts will be available to choose in the Period Adjustment plan, providing enhanced flexibility and efficiency in managing period adjustments.

Only invoices for costs may be accrued. The invoice must be registered and ready to be paid (status 4) to be accrued.

To open the Supplier invoices (SIN) application, find Finance in the RamBase menu and then Payables. Click Supplier invoices to enter the SIN application.

Select the invoice and click on the Accounting tab.

Click first on Adjustments and then click on the + icon next to the Period adjustment plan field. This will open the Item period adjustment plan popup.

To accrue several items on the document with different period adjustment plans or only one of the items:

Highlight the specific item in the Items tab and press ENTER to open the Supplier invoice item (SINITEM) application.

Click on the + icon nest to the Period adjustment plan field and continue the process from step 5.

Repeat the procedure for each item to be accrued.

In the Adj.% field the percentage of the total amount to be accrued may be edited. The value in this field calculates the value in the Adj.amount field.

Enter the amount to be accrued in the Ajd.amount field. The value in this field calculates the value in the Adj.% field.

In the FromPeriod field, enter the preferred period to start with.

In the ToPeriod field, enter the last period.

Press ENTER. The periods and their amount will be listed below.

Press F12 and choose the Register Account Adjustment Plan option.

The period adjustment is completed and the invoice is now accrued.

REP/101166 shows the value after accrual for the respective month. It shows the remaining amount for the period in question. (In other words, the amount that is left after this period's reversal.) This means that the total amount must correspond to the balance in the general ledger.

The report includes Sales Posting Adjustment (CPA) and Supplier Posting Adjustment (SPA) documents. It also has sub-reports, in which it is possible to filter on either CPA documents or SPA documents. To specify additional eligible accounts, just select Provisions & Prepayments from the Category dropdown menu in the Account information area of the Chart of accounts (ACC) application. Once categorized, these accounts will be available in the Period Adjustment plan, providing enhanced flexibility and efficiency in managing period adjustments. The report uses current period for the company as default filter, but it is also possible to filter on a different period. The filter should then be REP/101166;YYYYMM. Period adjustment balances (REP/101166) also offers a filtering option for the General ledger account (ACCCODE).

Filter by invoice: To filter by invoice, type OURNO="*XXXXXX", where XXXXXX should be replaced by the specific invoice number. The invoice number could be found in the OurNo field on Supplier Posting Adjustment (SPA) and Sales Posting Adjustment (CPA) documents.

When making posting adjustments you allocate the costs on account dimensions like department and project. Posting adjustments will make the cost accounting as accurate as possible.

Posting adjustments may be performed on both Supplier Invoices (SIN) and Sales Invoices (CIN).

Posting adjustments are to be performed on item level. Only items with a set account can be posting adjusted.

To open the Supplier invoices (SIN) application, find Finance in the RamBase menu and then Payables. Click Supplier invoices to enter the SIN application

To make a posting adjustment on one item:

Highlight the specific item in the Items tab and press ENTER to open the Supplier invoice item (SINITEM) application.

Click on the + icon nest to the Posting adjustment plan field.

Repeat the procedure for each item.

In the Adj.% field the percentage of the total amount to be adjusted may be edited. The value in this field calculates the value in the Adj.amount field.

Enter the amount to be adjusted in the Ajd.amount field. The value in this field calculates the value in the Adj.% field.

In the Split field, enter how many splits the invoice item should be split into.

Press ENTER. The splits and their amount will be listed below.

Press the magnifying glass for each split to enter dimension(s).

Use menu option Register Account Adjustment Plan to register it.

The period adjustment plan is forwarded to Status 4 if the invoice is not registered or Status 8 if the invoice is registered.

An overview of the GL posting appears on the invoice under the Accounting tab and the Adjustments sub-tab.

Open the Period adjustment plan popup for the chosen invoice. The invoice must be registered. Press the magnifying glass in the upper right corner. The pop-up Supplier/Customer Posting Adjustment menu opens and displays the period adjustment documents (SPA/CPA) for the chosen invoice.

REP/100951 with filter on the SIN/CIN can be used for follow-up/control. The filter should then be REP/100951;CIN/XXXXXX or REP/100951;SIN/XXXXXX

Use the Make period adjustments option in the action menu on a manually created General ledger (ATR) posting in Status 4. This will give you the possibility to make a period adjustment to a cost without an invoice.

Select the period in the FromPeriod and ToPeriod fields and click the OK button to make the period adjustments.

For an overview of the period adjustments, use the menu option and select the Show period adjustments option.

Use the Make period adjustments option in the action menu on a manually created General ledger (ATR) posting in Status 4. This will give you the possibility to make a period adjustment to a cost without an invoice.

Select the period in the FromPeriod and ToPeriod fields and click the OK button to make the period adjustments.

For an overview of the period adjustments, use the menu option and select the Show period adjustments option.

Accounting period closure is a predefined procedure in RamBase which is mandatory to work through for each accounting period.

To gain a more correct statement of expenditures and revenues in the period.

To control that there are consistency between the general ledger postings and the "real world" (reconciliations).

To a certain extent, the procedures are to be carried out in a specific order and approved by a financial manager.

If needed and desired, period adjustments of supplier invoices and sales invoices are created.

Correct cost of goods is calculated by transferring the inventory and product transaction values to the ledger. The calculation also considers the measurement problems according to which period transactions can be counted as stock value.

Several reconciliations must be approved.

Agio for foreign currency balance sheet entries are calculated.

Prior to period closure all postings like supplier invoices, sales invoices, and payments etc., for the relevant period must be completed.

In addition, you ought to perform the following reconciliations:

Reconciliation of the fixed assets register.

VAT reconciliation.

Bank reconciliation.

Inspect period adjustments.

To open the Fixed assets (FAR) application, find Finance in the RamBase menu and then Asset management. Click Fixed assets to enter the FAR application.

Press F12 to open the action menu and choose the option Forward new Investments to Fixed Assets Register. You will see Supplier invoices (SIN) registered against the investment ledger accounts.

By clicking the + icon to the left on the item line, you will create a Fixed asset (FAR) document which will hold all details about the investment. When the + icon has been clicked, the item will disappear from the popup.

Press Esc to return to the fixed assets menu. The new Fixed asset (FAR) document will be listed on top of the table. They are not yet activated (Status 1).

Highlight the desired document (Status 1) and press ENTER.

Press F12 to open the action menu and choose the Activate Fixed Asset (St=2) option.

In the new popup, set the period from when the asset shall be activated and click the OK button. The value of the asset is now debited into a balance account.

Press F12 and choose the Register & Create Depreciation Plan option. The asset is now booked in your balance and a depreciation plan is made, but the depreciation is not initiated. The Fixed asset (FAR) document is in Status 3.

It is possible to use the F12 option: Reopen & Delete Depreciation Plan on a Fixed asset (FAR) in Status 3.

Press Esc to return to the Fixed Assets Menu.

Repeat from step 5 for all Fixed asset (FAR) documents in Status 1 in the Fixed asset (FAR) application.

Press F12 and choose the option Make Depreciations to Fixed Assets.

Choose period for the depreciation.

Press the + icon to the right of each line. Press Esc to return to the Fixed Assets Menu. When the Fixed asset (FAR) document is depreciated for the first time, it will be forwarded to Status 4.

To perform VAT reconciliation you need to inspect the VAT codes and their connection to the relevant general ledger accounts. Make sure that no sales invoices are booked against an inbound VAT code, and that no supplier invoices are booked against an outbound VAT code.

To open the Finance Workspace (FINANCE) application, find Finance in the RamBase menu and then Overview. Click Overview to enter the FINANCE application.

Click on the VAT Reconciliation link in the Reports section to generate the VAT report.

This report gives an overview of VAT codes, where postings have been made for the chosen period.

Highlight the specific VAT code and press ENTER to inspect the underlying data.

If any mistakes are discovered, highlight the incorrect line and press ENTER to find the documents the postings are based on.

Make corrections.

Before starting a bank reconciliation, the bank statements have to be imported from the bank into RamBase. When bank statements are imported, the transactions are matched with Payment (PAY) documents recorded in the cash management module in RamBase.

The reconciliation job can be initiated manually or carried out automatically on a regular basis to your company's setup. Regardless of how the reconciliation job is initiated, the reconciliations must be inspected and confirmed manually.

Bank reconciliation must be done prior to period closure.

The Bank statements (BST) application list all transactions for a account over a set period. The statement includes deposits, charges, withdrawals. as well as the beginning and ending balance for the period, along with any interests.

The filtering options allow for easy organizing to the users' need.

The following areas are described in the sections below:

Bank statement area - Header right side

Bank transaction items area - Right side

The Bank statement area contains fields to help the user list only the intended Bank statement (BST).

Field | Icon | Description |

|---|---|---|

Bank field | Displays the Bank (BANK) identifier. | |

Bank account field | Bank account number | |

Currency field | Displays the currency selected for the bank account in the Bank (BANK) application. | |

Internal bank reference field | Sorting index of bank statement | |

External bank reference | ||

GL Account | Displays the name of General ledger account name |

Icon | ||

|---|---|---|

Booking date field | Displays the date the transaction was booked into the system. | |

Created by field | Either displays the identifier of the system batch job or the the Personnel (PER) identifier of the user who created the bank statement, including first and last name. | |

Created at field |

| Displays the date and time of creation |

| ||

Booked payments | Booked payments are figures which are imported from the Bank (BANK) application. After reconciling payments or confirming Bank statement (BST) items (when Bank statement (BST) goes to Status 8) these amounts are imported to Bank statement (BST). When status is < 8, Opening balance and Closing balance equals 0. | |

Opening balance | Balance at the beginning of the day, before Bank statement (BST) was created (it should equal Closing balance from the last day). | |

Linked payments | Sum of payments linked to Bank statement (BST). | |

Closing balance | Total amount of transactions for this bank, including created Bank statement (BST) - (Opening balance + Linked payments). | |

Bank transaction | Bank transaction shows amounts which are given when creating new Bank statement (BST), when Bank statement (BST) was created manually or imported from a file. When Bank statement (BST) is created using the Import bank statements from bank integration…operation, Bank statement (BST) is created automatically and amounts are imported from bank integration. They are visible when Bank statement (BST) < 8 and they are compared to Booked payments figures. | |

Opening balance | Balance at the beginning of the day, before Bank statement (BST) was created (it should equal Closing balance from the last day) | |

Movement | Sum of transactions in Bank statement (BST). | |

Closing balance | Total amount of transactions for this bank, including created Bank statement (BST) - (Opening balance + Movement). | |

Deviation | Booked payments – Bank transaction. |

Columns | Description |

|---|---|

St | Status of bank statement |

Item | Transaction identifier of the bank statement |

Created at | Date and time of creation |

Currency date | Currency date of the bank statement transaction |

Booking date | Booking date of the bank statement transaction |

Payments | Displays the related payment document with a navigation link. If there is more than 1 PAY document related with current transaction, then clickable money bag icon is displayed with all related payment documents list. |

Bank reference | Reference from the bank |

Internal message | Internal message from the system |

Transaction reference | Our internal reference |

Payment message | Message from the payment |

Reconciliation Id | Reconciliation identifier of the bank statement |